Image source: Getty Images

I personally think the best use for a Tax-Free Savings Account (TFSA) is growth. Passive income is great, but if you can delay gratification and let compounding work, you can build a big, tax-free nest egg over time.

That said, you need to be smart with risk-taking. Avoid penny stocks and meme stocks because if you take a loss, you can’t deduct capital losses in a TFSA.

Still, there’s a smarter way to maximize growth in a TFSA. My preferred approach is to apply light leverage to a portfolio of blue-chip Canadian dividend growth stocks.

Why use leverage?

Leverage lets you control more of an investment with less of your own money. Here’s an example.

Let’s suppose you have $1,000 to invest in a high-quality company, but you want to invest more than you have. In a margin account, which is a type of non-registered account, you could borrow an extra $250 to invest a total of $1,250.

This gives you 1.25 times leverage—meaning your $1,000 investment now controls $1,250 worth of stock. If the stock goes up, your gains are magnified, but if it drops, your losses are amplified, too.

Leverage comes with drawbacks. When you borrow on margin, you have to pay periodic interest on the loan, which eats into returns.

More importantly, if the value of your investment falls too much, your broker can issue a margin call, forcing you to deposit more cash or sell your holdings at a loss.

And here’s the biggest limitation: margin accounts aren’t allowed in a TFSA, so this strategy normally isn’t possible in a tax-free environment.

But there’s an exchange-traded fund (ETF) that gets around this problem.

1.25 times leveraged dividend growers

The solution is Hamilton CHAMPIONS™ Enhanced Canadian Dividend ETF (TSX:CWIN).

This ETF starts by assembling a portfolio of companies that track the Solactive Canada Dividend Elite Champions Index, which screens for stocks with at least six consecutive years of dividend growth.

The selected stocks are equally weighted, and on average, the portfolio has a 10% annual dividend-growth rate. You might even own some of them individually!

To enhance returns, CWIN borrows money within the fund—just like a margin loan—at institutional interest rates, applying light 1.25x leverage (or 25% additional exposure).

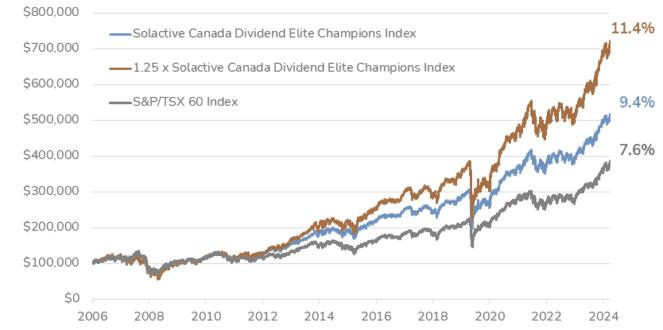

Historically, leveraging the Solactive Canada Dividend Elite Champions Index has outperformed both its unleveraged counterpart and the S&P/TSX 60, making it a strong option for investors looking to maximize growth.

CWIN pays monthly distributions, with the estimated payout for this month at $0.056 per share. At a share price of $15.83, that represents an annualized yield of 4.24%.