Willis Towers Watson Public Limited Company

WTW

has been benefiting from growing healthcare premiums, improved client retention, higher software sales and solid balance sheet.

Growth Projections

The Zacks Consensus Estimate for 2023 earnings per share is pegged at $15.23, indicating year-over-year increases of 12.6%. The expected long-term earnings growth is pegged at 16%, better than the industry average of 11.3%.

Earnings Surprise History

Willis Towers has a decent earnings surprise history. It beat estimates in each of the last four quarters, the average being 3.80%.

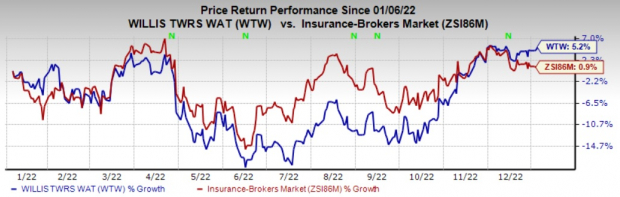

Zacks Rank & Price Performance

The company currently carries a Zacks Rank #3 (Hold). The stock has rallied 5.2%, outperforming the

industry

’s growth of 0.9% in the past year.

Image Source: Zacks Investment Research

Business Tailwinds

Health, Wealth & Career segment is expected to gain from higher demand for products and advisory work, new client appointments and growing healthcare premiums. Increased consulting work, strong client demand for talent and compensation products and employee engagement offerings are also likely to add to the upside.

Corporate Risk and Broking segment is expected to gain from double-digit growth across global lines of business, notably in Aerospace, Natural Resources and FINEX, improved client retention as well as strong contributions from both construction and M&A solutions.

Increased software sales and advisory work should continue to drive the Insurance Consulting and Technology business.

Willis Towers’ strategic inorganic expansion expanded its geographical footprint in the last few years, added capabilities and reinforced its portfolio.

Willis Towers re-cast its 2024 financial target following the divestiture of its Russian subsidiaries. The insurer projects the annualized run-rate impact from the divestiture of its Russian operations to be nearly $120 million. WTW remains committed to delivering mid-single digit organic revenue growth and 400-500 basis points of adjusted operating margin expansion. It expects to increase its revenues to more than $9.9 billion and to generate annual cost savings in excess of $360 million by the end of 2024.

Willis Towers remains focused on improving liquidity while maintaining a solid balance sheet. WTW had full capacity in undrawn $1.5 billion revolving credit facility, reflecting its sufficient cash reserves to meet its short-term debt obligations.

Willis Towers remains committed to enhancing its shareholders’ value and focused on deploying excess capital and cash flow into share repurchases. Riding on solid financial position, the insurer intends to continue to reward its shareholders, new business opportunities and pursue opportunistic mergers and acquisitions.

Stocks to Consider

Some better-ranked stocks from the insurance industry are

Root, Inc.

ROOT

,

Kinsale Capital Group, Inc.

KNSL

and

CNA Financial Corporation

CNA

, each carrying a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Root delivered a trailing four-quarter average earnings surprise of 22.44%. In the last six months period, ROOT lost 80.2%.

The Zacks Consensus Estimate for ROOT’s 2023 earnings indicates a year-over-year increase of 23.9%.

Kinsale Capital’s earnings surpassed estimates in each of the last four quarters, the average being 15.16%. In the last six months period, KNSL gained 6.9%.

The Zacks Consensus Estimate for KNSL’s 2023 earnings implies a year-over-year rise of 22.4%.

The Zacks Consensus Estimate for CNA Financial’s 2023 earnings implies a year-over-year rise of 12.5%. In the last six months period, CNA lost 3.6%.

The Zacks Consensus Estimate for CNA’s 2023 earnings has moved 2.5% north in the past 60 days.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock And 4 Runners Up

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report