Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

There are clearly Tesla fans (and, more importantly, shareholders) who will try to spin any news as positive for Tesla. It happens constantly, and it’s quite annoying when it’s obviously false and unrealistic. On the flip side, I’ve covered Tesla closely for 13 years, which means I’ve covered the dramatic successes of the company that many people said were impossible, lies, etc. Many people who ridiculed Tesla, Elon Musk, and their plans are still doing so prominently today — despite being so wrong in the past.

With Tesla at a very interesting point in its evolution, I want an honest and complete take on its financial situation, and I feel like that’s very hard to get. In this piece, I’m going to try to provide that at a high-level view, covering good and bad things from Tesla’s Q4 2024 shareholder letter and call, and also covering some unknowns. I’m sure I will miss things, so feel free to chime in with your own notes down in the comments.

Tesla Good News Financially

These are some key pieces of good news for the company:

- COGS came down significantly for Tesla vehicles. Well, they came down significantly in Q3, but then dropped even further in Q4.

- Despite some challenges, Tesla still made $8.4B non-GAAP net income in 2024 and $2.6B in Q4. The company is making a lot of money.

- It achieved an operating cash flow of $14.9B in 2024 ($4.8B in Q4) and free cash flow of $3.6B in 2024 ($2.0B in Q4). The company continues to bring in cash.

- Tesla’s Bitcoin investments have been helpful, adding $600 in net income as a result of the price of bitcoin rising.

- Energy generation and storage revenue grew 113% (and, really, energy storage revenue probably grew more than that, but I’ll come back to the details of that matter another day). It grew from $1.438 billion in Q4 2023 to $3.061 billion in Q4 2024.

- “Services and other” revenue rose 31%.

- “Net cash provided by operating activities” rose by 10%.

- “Cash, cash equivalents and investments” rose by 26%.

- Revenue from automotive regulatory credits rose from $433 million in Q4 2023 to $692 million in Q4 2024.

Tesla Bad News Financially

First of all, I think we have to acknowledge that most people care about Tesla’s finances just because they care about the stock price, and the stock price is based on massive, massive growth. So, saying that the company is profitable is really not enough to be a “good news story” with regard to TSLA. Tesla should be showing strong, rapid growth — or, at least, that should be what’s forecast — to justify the extremely high market cap. On that note, Elon Musk said on the conference call that he thought Tesla might one day be worth as much as the next 5 most valuable companies combined. I think most people, even many or most Tesla fans, would deem that a crazy idea, but it is now in the public record.

Here are some downers from the latest Tesla report:

- 8% decrease in automotive revenue in Q4 2024 versus Q4 2023 — from $21.6 billion to $19.8 billion.

- 6% decrease in automotive revenue in 2024 versus 2023 — from $82.4 billion to $77 billion.

- 6% decrease in gross profit in Q4 2024 versus Q4 2023 — from $4.44 billion to $4.18 billion.

- 1% decrease in gross profit in 2024 versus 2023 — $17.66 billion to $17.45 billion.

- An 18% increase in operating expenses in 2024 combined with a 20% decrease in income from operations. (Note that Tesla mentioned this in the key bullet points as “- increase in operating expenses driven by AI and other R&D projects.”

- Net income attributable to common stockholders (GAAP) decreased 53% in 2024.

- Free cash flow decreased 18% in 2024.

Tesla is still heavily dependent on its automotive business, and its auto sales were down in 2024. There’s no way that was going to look good financially. However, it reportedly looked worse than Wall Street expected — I assume due to the various incentives (like subsidized financing) Tesla was providing in order to try to sell more cars.

The Unknown

Tesla is still pitching a growth story, of course. If it wasn’t, the stock price would absolutely collapse. But we don’t know how much any of the company’s plans are actually going to work and lead to growth. Here are some big unknowns that will either help or hurt Tesla financially in the coming year and beyond:

- “Full Self Driving” becoming robotaxi ready — will Tesla’s approach to FSD, which has missed targets for 7 years, finally achieve its target, unsupervised robotaxi-capable self-driving? That’s the trillion-dollar question, again. Some believe, some no longer do.

- A lower-cost Tesla model (or two) is supposed to be unveiled later this year. That could jack up sales. The downside there, though, is that it could be a low-margin vehicle; it could steal sales from Tesla’s higher-cost, higher-margin vehicles, actually hurting Tesla financially; it’s not expected to be all that cheap — about $30,000 after incentives (which presumably includes the $7,500 US EV tax credit), or not much lower than the base Model 3.

- Tesla’s energy storage business could continue growing strong, after reaching more than ⅛ of Tesla’s automotive revenue total in 2024.

- Robots. Are they going to genuinely be a viable product, and a top-selling product for Tesla?

- AI services. Is Tesla going to launch some new, high-profit AI services?

- Even if Tesla makes a transition to robots and AI, will it do so quickly enough if auto sales decline?

- Also, how much will the company show an “increase in operating expenses driven by AI and other R&D projects” before Tesla can actually capitalize on that with robotaxi-capable cars and higher FSD sales?

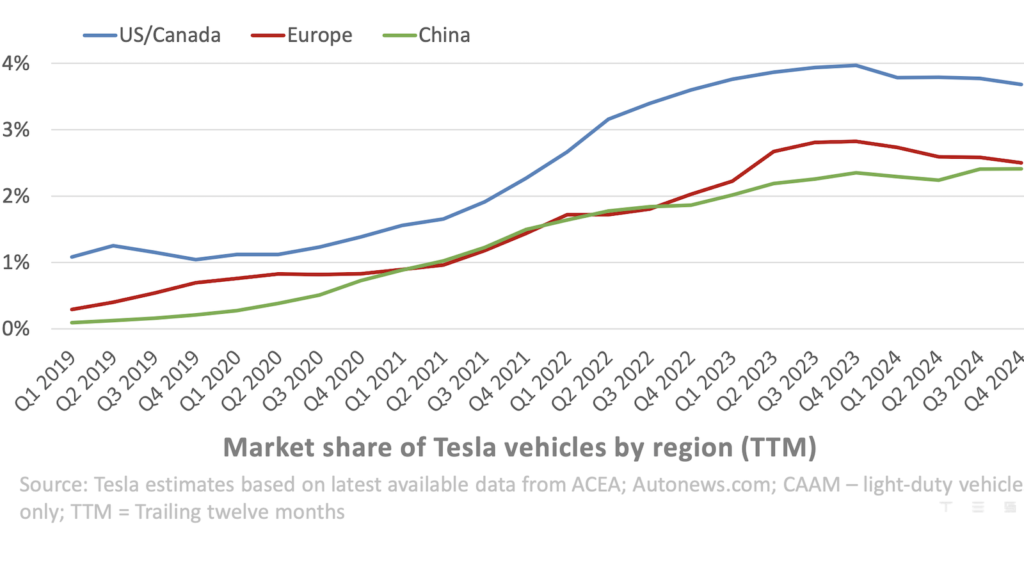

- Elon Musk has upset many consumers and across the US and Europe due to his far right-wing political involvement. That doesn’t seem to have hit Tesla sales too much in 2024, but will 2025 show a bigger drop in sales as a result? We have to wait to see.

To my eyes, Tesla is teetering on a knife’s edge. It needs auto sales to rise or at least hold for long enough that they fund other new aspects of the business, and it’s not clear at all (despite what Elon Musk might say) how long that will take. It’s also not clear at all how much Tesla’s auto business will actually grow, stagnate, or decline in 2025 due to a number of important matters. So, in the end, I find it a very hard company to forecast. It’s not at all at the stage it was 5 or 10 years ago when clear, solid, strong automobile sales growth was obviously coming.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy