Image source: Getty Images

There is no need to pick stocks — an exchange-traded fund (ETF) can do all the heavy lifting for you. And if you didn’t know, ETFs are eligible holdings in a Tax-Free Savings Account (TFSA), meaning your gains, dividends, and withdrawals are completely tax-free.

If you want to grow a TFSA, my advice is to stay agnostic about where your returns come from. That means don’t just chase income or growth — buy ETFs that appreciate in share price while reinvesting their dividends to compound returns over time.

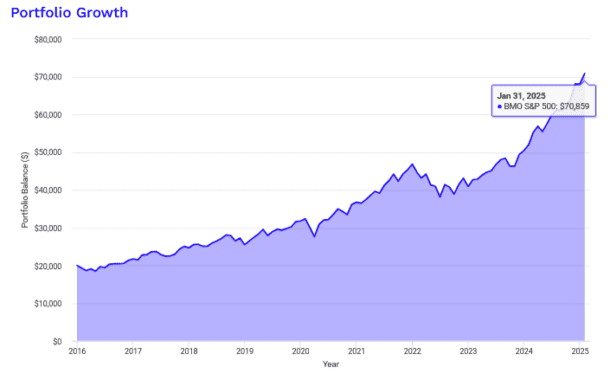

Here’s my preferred ETF for this strategy, plus a historical backtest showing how a $20,000 investment in it would have grown over time.

The ETF to buy

In my opinion, the best ETF to execute this strategy is BMO S&P 500 Index ETF (TSX:ZSP).

This fund tracks the S&P 500, an index made up of 500 of the largest publicly traded U.S. companies across all 11 sectors, offering broad diversification. Unlike some indices, the S&P 500 isn’t purely rules-based — stocks must be selected by a committee, which screens for size, liquidity, and earnings quality to ensure only financially strong companies make the cut.

The S&P 500 is market-cap weighted, meaning the largest companies — carry the most influence. This structure has historically favoured winners, allowing the index to consistently outperform over time. Another advantage? It’s extremely efficient, with only a 2% annual turnover, meaning it’s not constantly trading in and out of stocks.

With ZSP, you get exposure to this high-growth index at a low 0.09% management expense ratio (MER) — just $9 in fees per year on a $10,000 investment. If you want a simple, long-term ETF to compound wealth tax-free in a TFSA, this is it.

Historical backtest

An investor who put $20,000 into ZSP in January 2016 and reinvested all dividends would have seen their investment grow to $70,859 by January 2025.

Over this period, ZSP delivered an annualized return of 14.94%, proving its ability to generate strong long-term gains. But it wasn’t all smooth sailing — investors had to endure annualized volatility of 12.71%, meaning the market fluctuated significantly from year to year.

At its worst point, ZSP experienced a drawdown of -18.55%, meaning an investor would have seen their portfolio temporarily decline by nearly one-fifth. This is the reality of stock market investing — big gains come with periods of temporary losses.

The lesson? Buying an S&P 500 index ETF like ZSP is easy. The hard part is holding and resisting the urge to tinker or panic sell.