OTCQB: SPMEF | TSX.V: SPMC | FSE: 6J00

Under the Radar Gold & Copper Opportunity in Papua New Guinea

High Potential Explorer Poised for Huge Growth

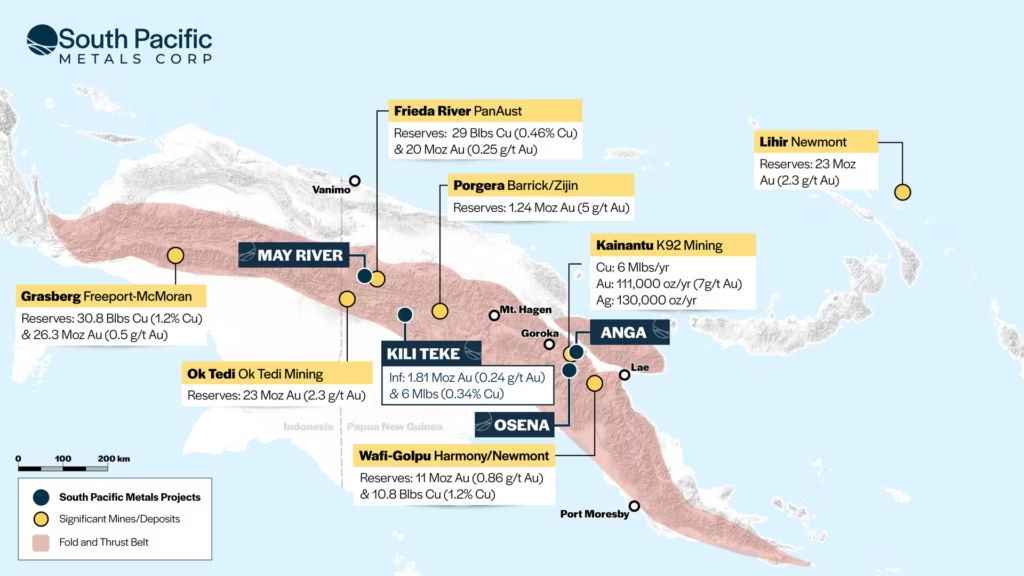

SOUTH PACIFIC METALS CORP (TSX.V: SPMC | OTCQB: SPMEF | FSE: 6J00) presents a compelling, under-the-radar investment opportunity as an emerging gold-copper exploration company operating in Papua New Guinea (PNG). Its four transformative gold-copper projects — Anga, Osena, Kili Teke, and May River — are strategically positioned adjacent to major producers and deposits like K92 Mining’s Kainanutu Gold Mine (latest Q results suggest on track to deliver 120.000-140.000| ounces Au this year and maiden mineral resource estimate for Arakompa by Q1 2025), PanAust’s Frieda River Deposit (contains 20 million ounces of gold and close to 30 billion pounds of copper) and Barrick/Zijin’s Porgera Gold Mine (a 10+ million ounces of gold resource).

And to sweeten the pot, SPMC’s Kili Teke Project ALREADY has Inferred Resources of 1.81 Moz Au and 1.71 Bllbs Cu based on a 2022 NI 43-101 report, with the potential to dramatically expand.

South Pacific holds an impressive 3,000 km² land package along one of the most active gold and copper mineralized regions in the world. In fact, sandwiched between SPMC’s Anga and Osena projects, K92 Mining has seen their share price increase 20-fold over the last five years from roughly USD $50 Million to USD $2+ Billion!

And to add fuel to the fire, South Pacific is led by a mining executive whose last gold company soared from startup to $2+ billion market cap.

So, is the potential for district-scale discovery and resource expansion upside here for South Pacific Metals? Gold is in high demand, and South Pacific Metals sits in the center of a prolific mining district. With analysts predicting the price of gold couldsurge by 50%, now is the time to explore this rising star in gold exploration.

New leadership and experienced in-country teams are in place and actively prioritizing exploration in regions known for world-class resources. And with multiple Q4 catalysts seemingly in place — along with a number of newly identified and highly attractive focus targets in their sights — it’s safe to assume that drill programs to help further define project resources are coming.

Key Highlights

1. Proven Region

PNG is globally known in the industry for gold reserves and resources, hosting multiple Tier 1 projects. In recent years, the country’s infrastructure has modernized and PNG has transitioned from being one of the most challenging regions for exploration to one of the most inviting. Look no farther than what’s happening with neighbouring K92 exploration and drilling – remember, they’re seeing impressive production stats of 111,000 ounces of gold, 6 million pounds of copper, and 130,000 ounces of silver annually.

2. Outstanding Projects

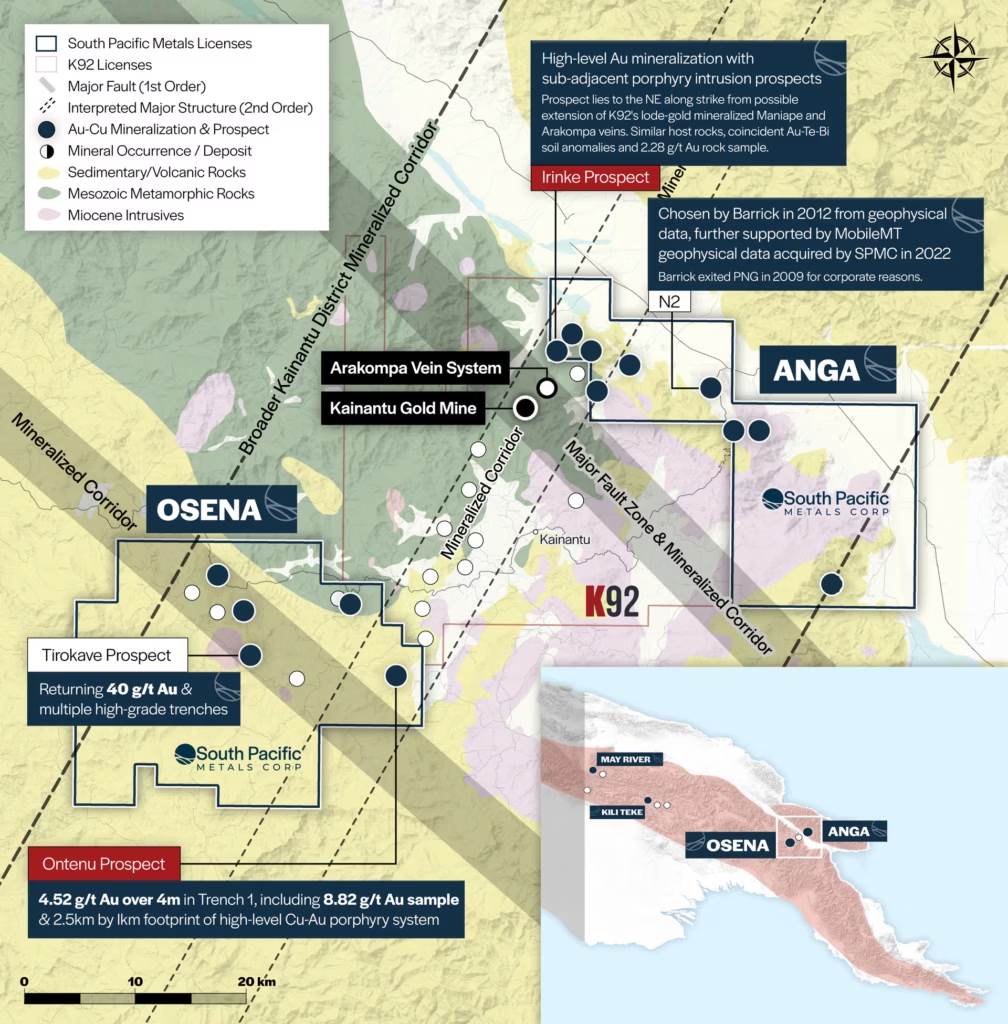

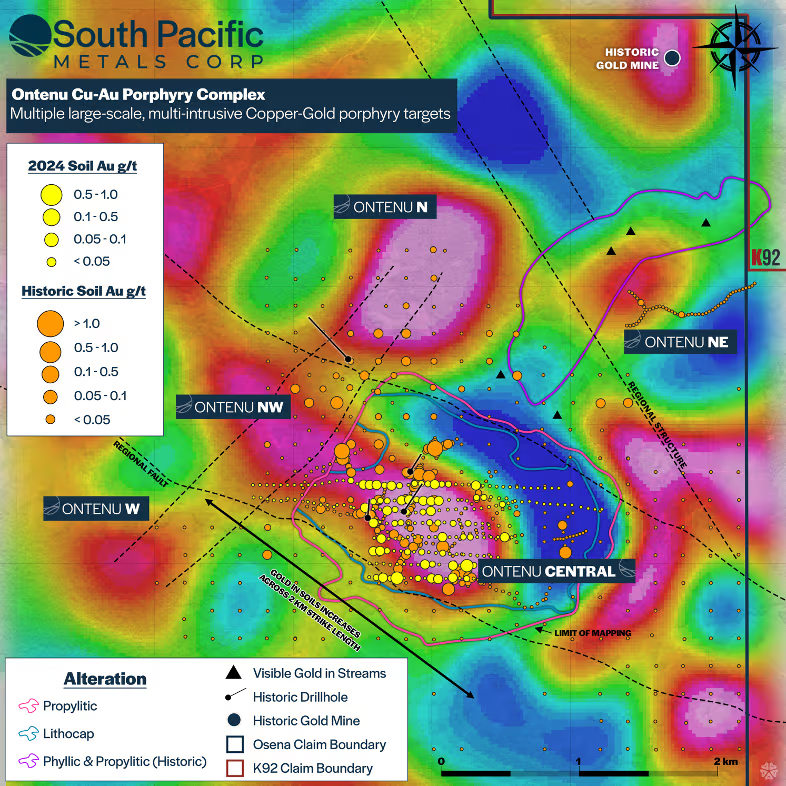

- Osena: Situated southwest of K92’s tenements, this 626 km² project covers a key structural corridor rich in Au-Cu-Ag veins. Early results from the Ontenu prospect include a cluster of large Copper-Gold targets and promising gold grades (up to 8.82 g/t Au) along with other notable mineral anomalies.

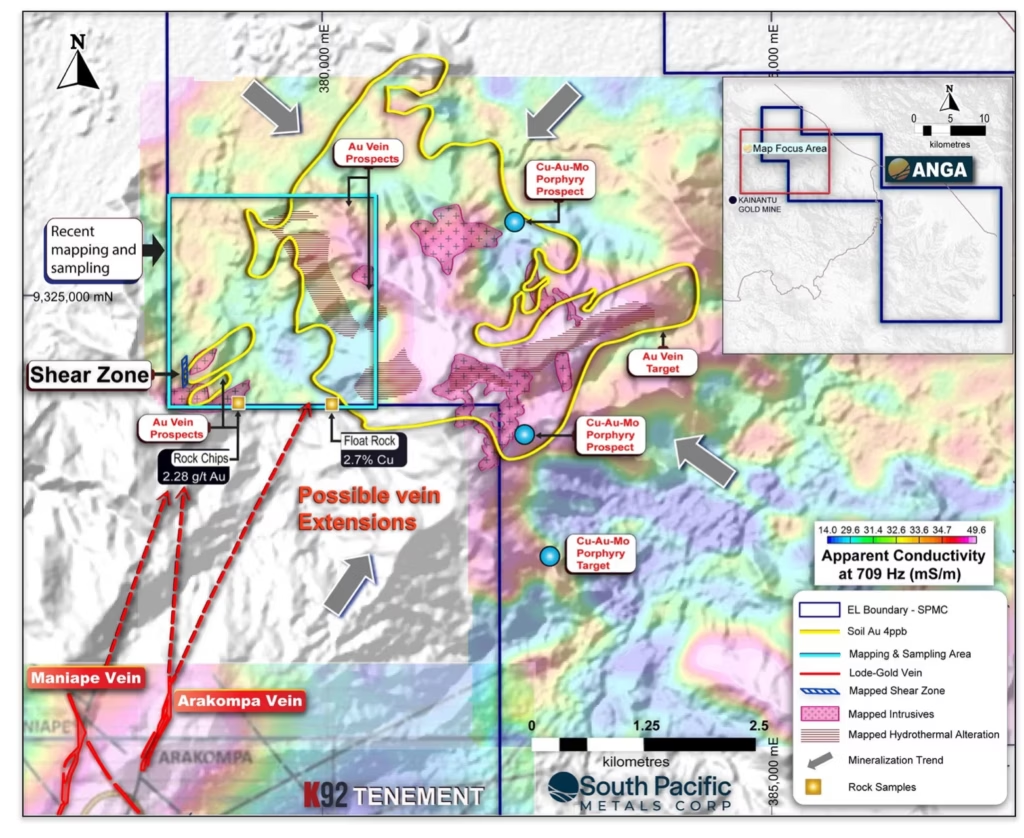

- Anga: Adjacent to K92’s Arakompa drill program, the Anga project boasts geological similarities to high-grade discoveries nearby. Only 3 km away from Arakompa’s action there’s strong potential that this mineralization continues into Anga’s holdings.

- Kili Teke: With an Inferred Resource of 1.81 Moz Au and 1.71 Blbs Cu, this project offers strong upside with 10 newly identified targets that could substantially boost defined resources.

- May River: Bordering the massive Frieda River project, May River offers the potential for large-scale copper-gold deposits. A review is in progress to target large-scale copper-gold porphyries and epithermal gold vein systems.

3. Industry's Best Mix of Assets

With multiple copper-gold targets identified across its portfolio, South Pacific Metals is ready to capitalize on both metals’ rising demand. A dual-metal play that offers unmatched growth potential with electrification and decarbonization movements and as a safe-haven hedge against economic uncertainty.

Catalysts & Exploration

Multi-stage exploration programs underway. SPMC has multiple near-term catalysts, including assay results, program updates, and ongoing exploration activity at its key prospects. The proximity of SPMC’s projects to producing mines and active exploration zones boosts the potential for success.

Immediately adjacent and flanking K92’s active drilling and gold producing operations to the northeast and southwest, SPMC’s Anga and Osena Projects are located within the high-grade Kainantu Gold District along a major 45 km Cu-Au mineralized trend. Each project shows similar geological, structural and metal associations to K92, with evidence of large-scale Copper-Gold porphyry and vein systems present. Exploration updates should be coming for Q4 as the company has stated that drill planning is in progress.

Strong Capital Structure and Strategic Support

The company has a tight share structure, with 38 million shares outstanding and 70% owned by insiders and strategic investors. SPMC benefits from seasoned management and don’t forget that its Executive Chair took his last gold company from startup to $2+ billion market cap. Significant government support and established in-country teams further strengthens SPMC’s abilities to advance its key projects.

The Verdict

Hidden Value and Primed for a Break Out

In one of the most gold-rich yet under-explored regions in the world, South Pacific Metals’ project portfolio set to deliver. With strong community ties and favourable government support, the path to success is clear.

To summarize, South Pacific Metals Corp holds significant potential with its high-quality assets, experienced leadership, and strategic positioning in one of the world’s most mineral-rich regions. And while it’s clear that drilling plans are being assembled, fortune favours those that can lock into positions BEFORE gold, copper and other discoveries are drilled and announced. Keep an eye on this emerging company for growth in the Gold-Copper sector.

Learn more at South Pacific Metals.

Stay informed. Sign up here to receive News and Updates.

Project Details

- OSENA: Covering 626 km² of strategic ground, the Osena Copper-Gold Project is located southwest adjacent to K92’s tenements that host the Kainantu Gold Mine. A major NE trending structural corridor known for high-grade Au-Cu-Ag veins is interpreted to extend into Osena land holdings. Focus prospects include Ontenu, a large-scale, multi-intrusive Copper-Gold porphyry, vein and skarn complex extending over 5 km x 3 km, with a cluster of at least four highly-prospective geophysical targets with correlating surface Cu-Au anomalies. Recent results from Ontenu Central confirm gold-bearing breccias and include 79 m averaging 0.75 g/t Au, including 4 m at 4.52 g/t Au and individual samples up to 8.82 g/t Au. Historical rock samples targeted for follow-up include 73 g/t Au, 960 g/t Ag, 3.17% Cu & 10.6% Zn (in different locations).

- ANGA: The Anga Gold-Copper Project comprises 461 km² of a 100%-owned land package located northeast adjacent to K92’s current Arakompa drill program (which continues to record multiple high-grade gold zone intercepts just 3 km away). Irinke Prospect exploration, highlighted by a newly identified sulfide-bearing shear zone exposed over 17 metres x 2 metres with geological similarities to K92’s Arakompa lode gold-copper-silver vein, was just completed with 237 soil and rock chip samples assays pending.

- KILI TEKE: The Kili Teke Project, acquired from Harmony in late 2023, consists of a 253 km2 land package located approximately 40 km west of the Porgera Gold Mine, in the Western Highlands of Papua New Guinea. Kili Teke’s Central Porphyry currently hosts an Inferred Mineral Resource of 1.81 Moz Au and 1.71 Blbs Cu, and results from a recent targeting exercise have revealed 10 new porphyry, skarn and “Porgera-style” Au exploration targets proximal to the Central Porphyry.

- MAY RIVER: Acquired in 2023 and fully owned, the May River Project spans 1,697 km² of land adjacent to the Tier-1 Frieda River Cu-Au Project, one of the world’s largest undeveloped copper-gold projects at an estimated 29 billion pounds of copper and 20 million ounces of gold. The project is situated in a geological and structural setting similar to Frieda River, and near a northeast trending structure that also includes the OK Tedi mine. It features a 7 km north-northwest trending structural corridor with two drill-confirmed high-sulfidation gold occurrences. Desktop review and re-interpretation of extensive historic and modern datasets (geochemical, geophysics, geological, and drilling) is underway to target large-scale porphyry copper-gold and epithermal gold vein systems.Learn more at South Pacific Metals.

Sign Up For to Get the Investor Pack

Disclaimer: This release/advertorial is a commercial advertisement and is for general information purposes only. This is a Native Advertisement, meaning it is an informational marketing piece. STOCKSPEAK.com, owned makes no recommendation that the securities of the companies profiled or discussed on this website should be purchased, sold, or held by viewers that learn of the profiled companies through our website. Please review all investment decisions with a licensed investment advisor. STOCKSPEAK.com has been paid a $1,000 fee for hosting this information created by 45 Degrees, SPC and takes no responsibility for the hosted content. Embeded Discord channels receive no compensation and STOCKSPEAK is not responsible for and can not control user generated content within the discord embed. Commentary should not be considered investment advice. This Advertorial was paid for in an effort to enhance public awareness of and its securities. 45 Degrees has received $105,000 for advertising efforts. 45 Degrees does not currently hold the securities of and does not currently intend to purchase such securities. This Advertorial contains forward-looking statements that involve risks and uncertainties. This Advertorial contains or incorporates by reference forward-looking statements, including certain information with respect to plans and strategies of the featured Company. As such, any statements contained herein or incorporated herein by reference that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the foregoing, the words “believe(s)” “anticipate(s)”, “plan(s)” “expect(s)” “project(s)” “will” “make” “told” and similar expressions are intended to identify forward-looking statements. There are several important factors that could cause actual events or actual results of the Company to differ materially from these indicated by such forward-looking statements. Certain statements contained herein constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and 21E of the Exchange Act of 1934. Such statements include, without limitation, statements regarding business, financing, business trends, future operating revenues, and expenses. There can be no assurance that such expectations will prove to be correct. Investors are cautioned that any forward-looking statements made by the Company or contained in this advertorial are not guarantees of future performance, and that the Issuer’s actual results may differ materially from those set forth in the forward-looking statements. Difference in results can be caused by various factors including, but not limited to, the Company’s ability to be able to successfully complete planned funding agreements, to successfully market its products in competitive industries or to effectively implement its business plan or strategies. To reiterate, information presented in this advertorial contains “forward-looking statements”. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions, or future events or performance are not statements of historical fact and may be “forward-looking statements.” Forward-looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements in this advertorial may be identified through the use of words such as “expects,” “will,” “anticipates,” “estimates,” “believes,” “may,” or by statements indicating certain actions “may,” “could,” or “might” occur. More information on the Company may be found at www.sec.gov readers can review all public filings by the Company at the SEDAR and/or SEC’s EDGAR page. 45 Degrees is not a certified financial analyst or licensed in the securities industry in any manner. The information in this Advertorial is subjective opinion and may not be complete, accurate or current, so this could create a conflict of interest.

Contact Us

45 Degrees, Inc

1601 Central Ave Cheyenne, WY 82001

Phone +1.564.218.0331

email:

Copyright 2025. 45 Degrees, Inc.. All Rights Reserved.