Introduction

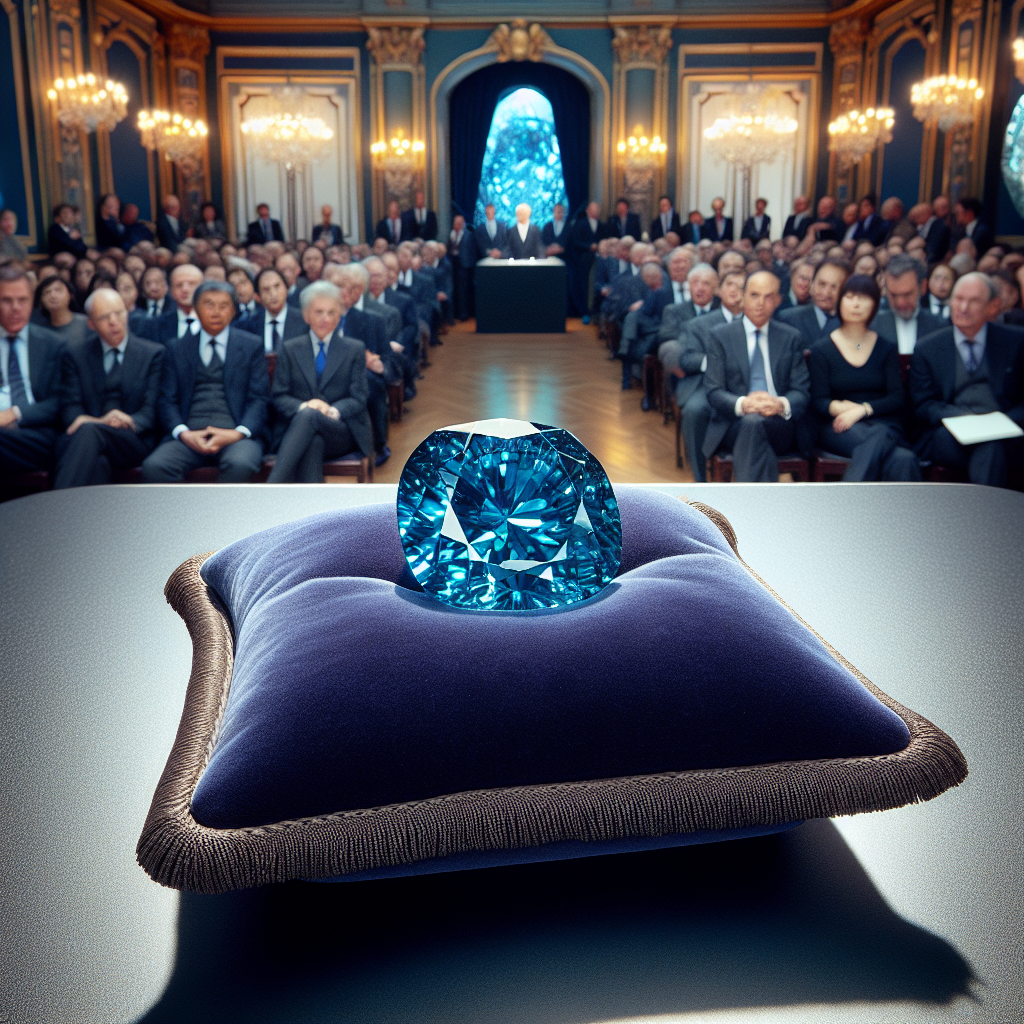

A unique 10-carat blue diamond is expected to fetch a staggering $20 million at auction, offering a rare opportunity for investors in the luxury goods market. This comes as recent drill results from the project’s Blackjack zone returned 94 metres grading 1.15 g/t gold from 437 metres down, highlighting the significant exploration potential of the site.

Investment Potential in Luxury Goods

The luxury goods market, particularly rare gemstones like blue diamonds, has long been a lucrative investment avenue. The rarity and unique characteristics of these gemstones make them highly sought after, often fetching astronomical prices at auctions. The expected $20 million price tag for the 10-carat blue diamond is a testament to this trend.

Exploration Potential and Recent Drill Results

While the blue diamond is the star of the show, the project’s Blackjack zone has also shown promising results. Recent drill results returned 94 metres grading 1.15 g/t gold from 437 metres down. This indicates a significant presence of gold, a precious metal that has consistently proven to be a safe and profitable investment.

The exploration potential of the Blackjack zone is immense. The presence of gold, coupled with the possibility of unearthing more rare gemstones like the blue diamond, makes this an attractive prospect for junior mining investors. The recent drill results are a positive sign, indicating the potential for high returns on investment.

Implications for Junior Mining Investors

For junior mining investors, these developments present a unique opportunity. The combination of the high-value blue diamond and the promising gold assay results from the Blackjack zone offer a dual investment opportunity. The potential for high returns from the sale of the diamond, as well as the gold deposits, make this an attractive proposition.

Investors should, however, be aware of the risks associated with mining investments. While the potential for high returns is significant, so too are the risks. These include geological risks, market volatility, and regulatory changes, among others. As such, a thorough risk assessment is crucial before making an investment decision.

Summary

The expected $20 million auction price for the 10-carat blue diamond, coupled with the promising gold assay results from the Blackjack zone, present a unique investment opportunity in the luxury goods and junior mining sectors. Investors should, however, be aware of the associated risks and conduct a thorough risk assessment before making an investment decision. Going forward, investors should keep an eye on the auction results for the blue diamond and further exploration results from the Blackjack zone.