What Happened

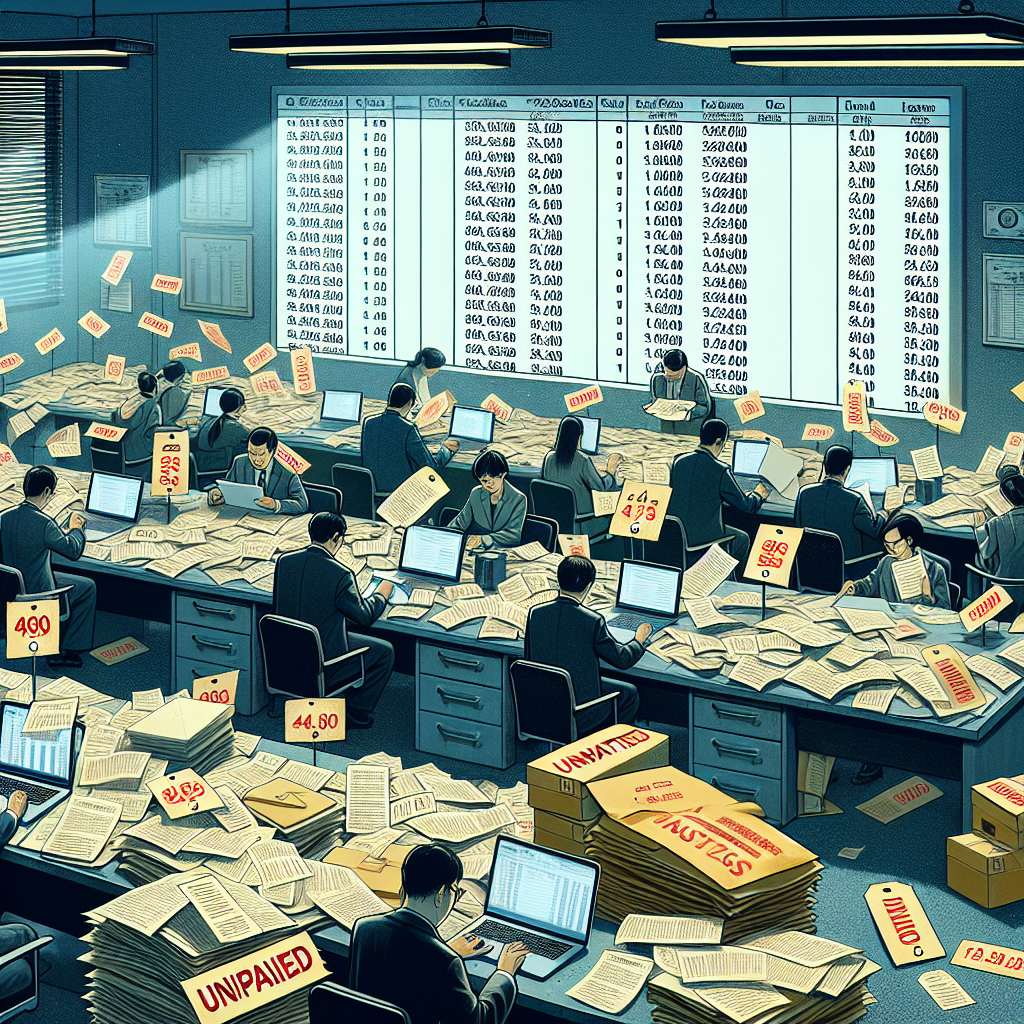

In a recent development, Inland Revenue has uncovered millions in unpaid taxes from property developers and investors. The discrepancies were found in undeclared income tax and Goods and Services Tax (GST) from the property sector. This revelation has sent shockwaves through the industry and has significant implications for investors.

Unpaid Taxes in the Property Sector

The property sector has been under the scanner for some time now, with authorities stepping up their efforts to ensure compliance with tax laws. The recent discovery of unpaid taxes by Inland Revenue has brought to light the extent of the problem. The discrepancies were found in undeclared income tax and GST, which are significant sources of revenue for the government.

While the exact amount of unpaid taxes has not been disclosed, it is believed to be in the millions. This is a significant sum, and its recovery could have a substantial impact on the government’s finances. It also raises questions about the practices of property developers and investors, and whether they are meeting their tax obligations.

Implications for Investors

This development has significant implications for investors in the property sector. The discovery of unpaid taxes could lead to increased scrutiny of property developers and investors, potentially leading to fines and penalties. This could impact the profitability of these companies and, by extension, the returns for investors.

Furthermore, this could also lead to a tightening of regulations in the property sector. The government may introduce stricter rules to ensure compliance with tax laws, which could increase the cost of doing business. This could also impact the returns for investors.

Regional Impact and International Relevance

While this development is specific to New Zealand, it has international relevance. Many countries are grappling with similar issues in their property sectors, and the steps taken by Inland Revenue could serve as a model for other jurisdictions. This could lead to a global tightening of regulations in the property sector, impacting investors worldwide.

For investors in the NZX and other international markets, this development underscores the importance of due diligence. It is crucial to understand the tax practices of property developers and investors, and to factor in the potential risks associated with non-compliance.

Summary

The discovery of unpaid taxes in the property sector by Inland Revenue is a significant development. It has implications for property developers and investors, potentially leading to increased scrutiny and tighter regulations. For investors, this underscores the importance of due diligence and understanding the tax practices of companies in the property sector. Going forward, it will be important to watch how this situation unfolds and what steps are taken to recover the unpaid taxes.