Every year, the world throws away over 400 million tons of plastic. Less than 10% is recycled. The rest? It ends up incinerated, landfilled, exported, or leaking into ecosystems as microplastic pollution.

But here’s what most people don’t realize: it’s incredibly expensive to throw plastic away.

In some regions of Europe, it costs more than $2,000 per ton to properly dispose of contaminated plastic waste. In the U.S., where regulations are looser, disposal costs are lower—but rising rapidly. And with the introduction of Extended Producer Responsibility (EPR) fees and global plastic taxes, costs are expected to surge.

This is the backdrop against which Aduro Clean Technologies ($ADUR) is emerging as one of the most compelling cleantech opportunities of the decade.

The Real Cost of Disposing Plastic

Let’s break down what it currently costs to get rid of plastic waste:

-

- Collection: Labor, sorting, and transportation (typically 50–100 miles)

-

- Tipping Fees: The cost to dump waste at a landfill, varying by region and regulatory burden

-

- Taxes & EPR Fees: Europe charges up to €0.80/kg (~$880/ton) in plastic-specific taxes. The U.S. doesn’t yet, but it’s coming.

Dirty plastic, especially post-consumer mix, is the most expensive to dispose of. Many companies pay up to $2,000+ per ton to get rid of it. And that’s before factoring in the global cost of environmental damage.

Meanwhile, the only widely used technology capable of handling contaminated plastic today is pyrolysis — a high-heat, high-emission process that is essentially industrial incineration. It’s expensive, inefficient, and environmentally dubious. And the yields? Disappointingly low.

The Pyrolysis Problem

Pyrolysis melts plastic into a synthetic oil, which can be refined into fuels or chemical feedstock. But it comes with several serious issues:

-

- Low yield: Much of the plastic is lost as gas or unusable char

-

- High energy demand: Requires extreme heat and often external hydrogen

-

- Environmental impact: Generates emissions and often uses fossil fuels in the process

-

- Economic inefficiency: Complex infrastructure, long permitting times, poor returns

For all this effort, pyrolysis still requires relatively clean feedstock. Once you add in food residue, adhesives, multilayer films, or colorants, yield plummets.

Which is why Aduro’s alternative is turning heads.

Aduro: Clean Tech With Teeth

Aduro Clean Technologies has developed a patented, water-based process called Hydrochemolytic™ Technology (HCT). It uses hot, pressurized water to break down plastics into valuable outputs without incineration, without toxic solvents, and without requiring pristine feedstock.

What makes HCT different?

-

- Resin-agnostic: Can process PE, PP, PS, and even crosslinked polymers like tires

-

- Contaminant-tolerant: Doesn’t require pre-cleaned or sorted waste

-

- High yield: Up to 95% yield from PP; 84% from tire-derived material

-

- Low carbon: Uses water as a hydrogen source, eliminating the need for gas

This means Aduro can take the worst waste streams—the kind that cost $2,000/ton to dispose of—and turn them into valuable feedstocks.

The PureCycle Contrast

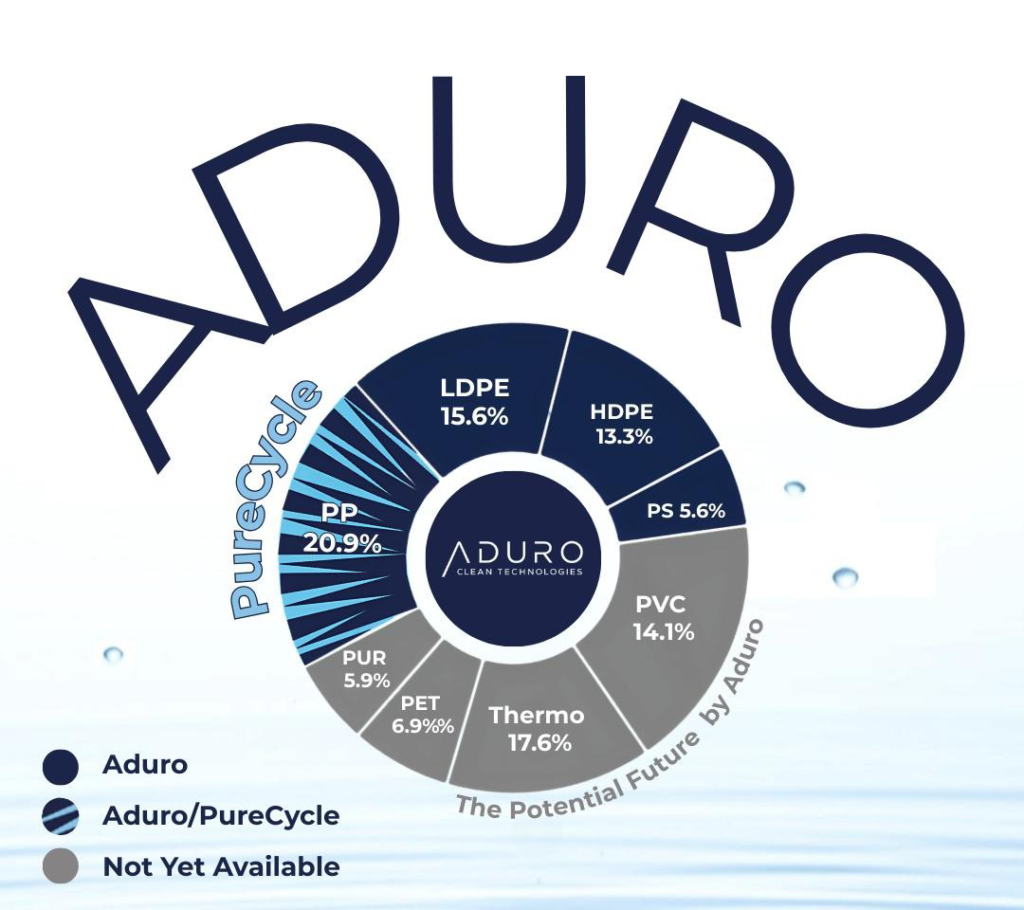

To understand how different Aduro is, consider PureCycle Technologies ($PCT). With a market cap of $1.3 billion, PureCycle is one of the most hyped names in advanced recycling. But they only recycle one type of plastic: polypropylene (PP). And even then, only when it’s relatively clean.

Despite their valuation, PureCycle has never published yield data.

Meanwhile, Aduro handles PP, PE, PS, and more- nearly 70% of all plastics that come from municipal waste

Big Clients, Real Revenue Paths

Aduro isn’t operating in a vacuum. The company has already signed seven multi-billion dollar clients through its Customer Engagement Program (CEP), including Shell and TotalEnergies.

This CEP structure brings in:

-

- Technical validation

-

- Feedstock testing

-

- Partner-specific process development

And it’s not just testing: Aduro plans to complete its Next Generation Pilot Plant (NGP) in Q3 2025. This system is modular, scalable, and designed for real-world throughput—providing the foundation for demo plants and, eventually, commercial deployments.

The Business Model: Licensing, Not Landfills

Instead of building massive recycling plants themselves, Aduro will license its technology to infrastructure owners, waste processors, and industrial players.

-

- Low capex model

-

- High-margin licensing revenue

-

- Fast scalability

According to analyst projections by D Boral Capital, licensing even 1 million tons/year could generate over $100 million in EBITDA.

With a projected 20x EBITDA multiple, that implies a $2 billion+ valuation by 2027–2028—versus a current market cap under $150 million.

A Total Addressable Market of $290 Billion

Aduro’s technology applies across three verticals:

-

- Plastic Waste Upcycling (HPU) — $120B TAM

-

- Bitumen Upgrading (HBU) — $50B TAM

-

- Renewable Oils & Fuels (HRU) — $120B TAM

Combined, that’s a $290B addressable market, and Aduro owns the IP. As of May 2025, it holds 10 patents (7 granted, 3 pending) covering reactor designs, catalysts, and configuration schemes.

And this isn’t just speculative IP. Independent lab validation, commercial partnerships, and international policy trends are converging to accelerate its deployment.

Investors Are Starting to Notice

D Boral Capital initiated coverage of Aduro in March 2025 with a Buy rating and a $50 price target, based on:

-

- 10-year discounted cash flow (DCF)

-

- Discounted EPS model

-

- Conservative ramp of licensing and demo plant revenue

Their base case sees Aduro reaching $875 million in revenue by 2035 with $400+ million in net income. That’s over $10/share in earnings, implying a huge margin of safety at today’s sub-$7 share price.

Bottom Line: From Plastic Crisis to Profit Engine

Every ton of plastic that needs disposal is a cost. For many companies, it’s a six-figure line item. For governments, it’s a multi-billion dollar problem.

Aduro Clean Technologies offers a scalable, environmentally responsible way to turn that cost into revenue.

They’re not trying to outcompete traditional recyclers. They’re building an entirely new category.

Disclosure: I am a long-term shareholder in Aduro Clean Technologies, I am not paid in any way by the company. The above is my opinion and should not be construed as financial advice. Investing is risky, consult a financial advisor.