Adyen and JCB Introduce Card-on-File Tokenization for Improved Payment Security

Adyen, the global payments platform of choice for many of the world’s leading companies, and JCB, a major global payment brand and leading payment card issuer and acquirer in Japan, have announced a significant step forward in payment security. The two companies have introduced card-on-file tokenization, a feature that enhances the security of stored card details by replacing sensitive card data with a unique identifier or ‘token’. This move is set to improve payment security, reduce fraud, and increase conversion rates.

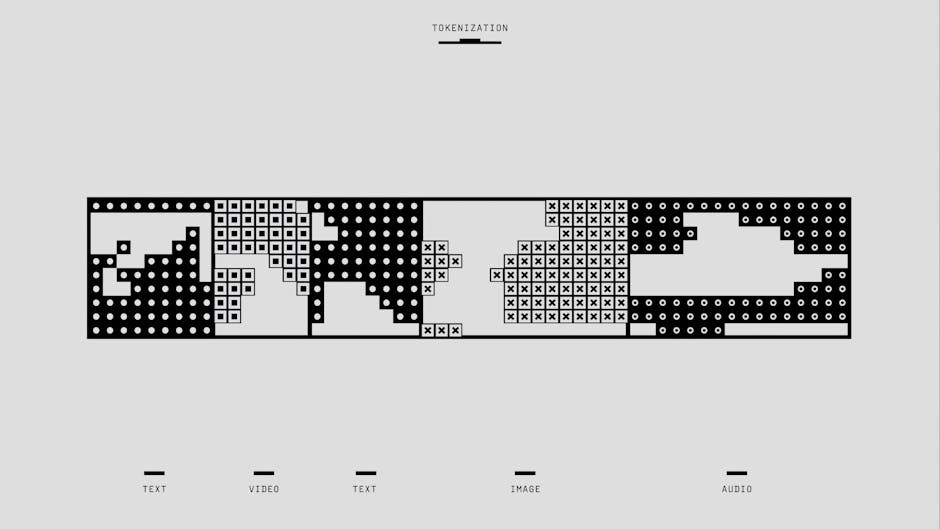

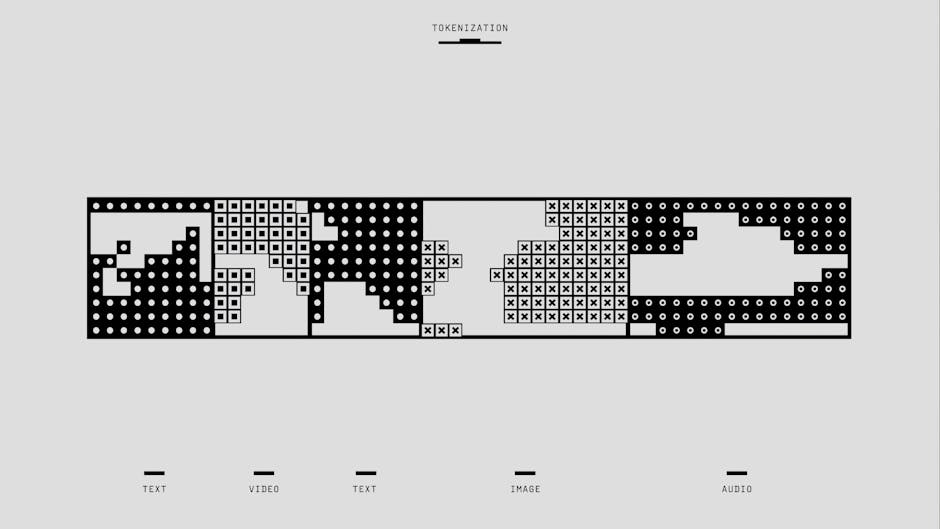

Understanding Card-on-File Tokenization

Card-on-file tokenization is a process that replaces sensitive card data with a unique identifier or ‘token’. This token can be used to process payments without exposing actual card details, thereby enhancing payment security. This technology is particularly beneficial for businesses that store customer card details for recurring payments or one-click checkouts, as it significantly reduces the risk of data breaches and fraud.

Implications for Adyen and JCB

For Adyen, this partnership with JCB represents another step in its ongoing commitment to improving payment security and enhancing customer experience. Adyen’s platform already supports a wide range of payment methods across online, in-app, and in-store environments. The addition of card-on-file tokenization will further strengthen its offering, particularly for businesses that operate on a subscription model or offer one-click checkouts.

For JCB, this collaboration with Adyen will help to expand its global footprint and enhance its reputation as a secure and convenient payment method. JCB cards are already accepted in 190 countries and territories, and this new feature will make JCB cards even more attractive to businesses and consumers alike.

Investment Perspective

From an investment perspective, this development is likely to be viewed positively. Adyen’s shares have already been performing well, driven by the ongoing shift towards digital payments. This new feature could further boost Adyen’s growth by attracting more businesses to its platform and encouraging existing customers to make greater use of its services.

For JCB, this development could help to drive international growth and increase market share. As businesses and consumers become increasingly aware of the importance of payment security, features like card-on-file tokenization could become a key differentiator.

Emerging Tech Implications

This move also highlights the growing importance of cybersecurity in the payments industry. As businesses and consumers become increasingly reliant on digital payments, the need for secure payment solutions is becoming ever more critical. Companies that can offer secure, convenient, and innovative payment solutions are likely to be well-positioned for growth in this rapidly evolving market.

Summary

This collaboration between Adyen and JCB to introduce card-on-file tokenization represents a significant step forward in payment security. For investors, this development could signal further growth for both companies, driven by the ongoing shift towards digital payments and the growing importance of payment security. Looking ahead, investors should keep an eye on how this new feature is received by businesses and consumers, as well as any impact on Adyen’s and JCB’s growth and market share.