Not everyone needs to be 100% invested in stocks. If you’re older or simply have a lower appetite for risk, there’s nothing wrong with shifting part of your portfolio into fixed income.

By that, I mean bond exchange-traded funds (ETFs) and Guaranteed Investment Certificates (GICs)—two options that can keep your money safe while generating monthly income.

Here’s my five-minute guide to getting started with both, plus some choice picks to consider.

GICs: Steady and safe

If you want the ultimate in safety, GICs are as secure as it gets.

When you buy a GIC, you’re essentially lending money to a bank or credit union for a set term, which can range from a few months to several years. In exchange, you receive interest payments, and when the term ends, you get your original investment back in full.

The “guaranteed” part means your money won’t disappear, even if the bank fails. That’s because GICs are insured by the Canada Deposit Insurance Corporation (CDIC), which covers up to $100,000 per eligible account per institution.

The trade-off? Your money is locked in for the term. You can withdraw early, but it usually comes with a penalty—often forfeiting any earned interest. That’s why you should never buy a GIC unless you’re sure you won’t need that money during the term.

This makes GICs a poor choice for an emergency fund but a great option for a defined financial goal. If you know you’ll need money for a house down payment in a year, for example, locking in a one-year GIC can guarantee your capital while earning interest.

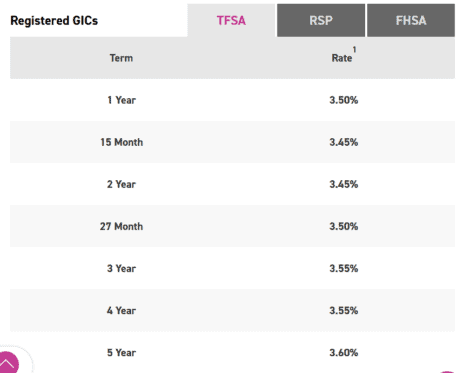

For GICs, I like EQ Bank’s offerings. Below is a screenshot of their rates as of February 4th for registered accounts. The yields shown are annualized, meaning they reflect what you’d earn per year.

Bond ETFs: Flexible and low risk

If you want the ability to sell at any time, consider a bond ETF. These funds hold a basket of different loans and trade like stocks while passing the interest payments to investors each month.

Not all bond ETFs are created equal. Some are highly sensitive to interest rates—when rates fall, their prices go up, but if rates rise, like in 2022, they can lose value.

Others carry higher credit risk, meaning they invest in riskier loans that are more likely to default. These tend to pay higher interest, but that’s compensation for the added risk.

I tend to gravitate toward bond ETFs with low risk on both dimensions. A prime example is Global X 0-3 Month T-Bill ETF (TSX:CBIL).

This ETF is a great alternative to a savings account. It only holds Treasury bills issued by the Government of Canada that mature within three months, making it one of the safest fixed-income options available.

As of February 3, CBIL is paying a 3.22% annualized yield, with monthly payouts. The price barely moves, usually hovering around $50, making it a stable and liquid choice for conservative investors.