Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and/or follow us on Google News!

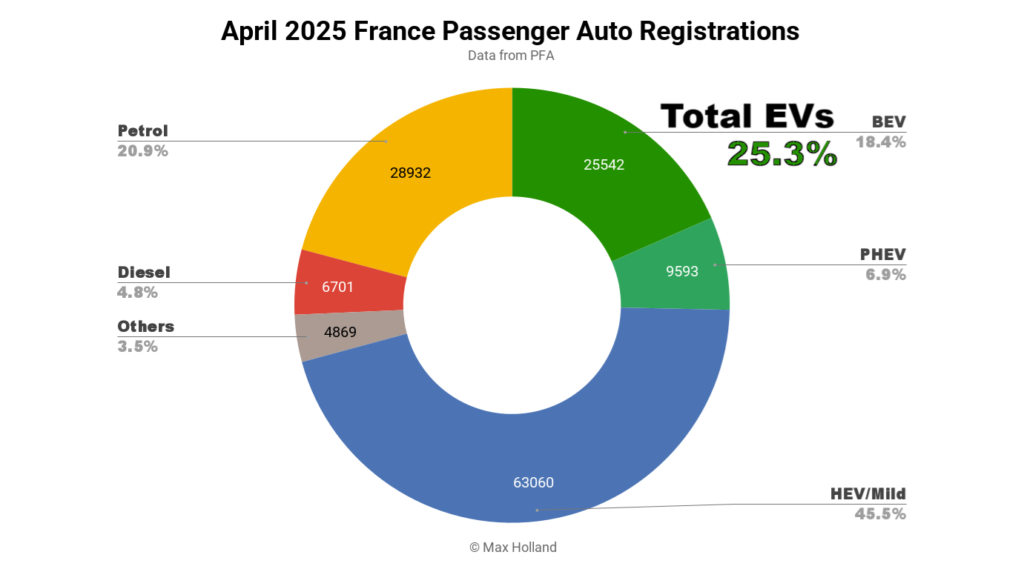

April’s auto market saw plugin EVs at 25.3% share in France, up from 24.3% year-on-year. BEVs were slightly up in share YoY, whilst PHEVs were fractionally down. Overall auto volume was 138,697 units, down some 6%YoY. The Renault 5 was France’s best selling BEV in April.

April saw combined EVs at 25.3% share in France, with full battery electrics (BEVs) at 18.4%, and plugin hybrids (PHEVs) at 6.9%. These compare with YoY figures of 24.3% combined, 16.9% BEV, and 7.4% PHEV.

Recall the context of France’s EV transition:

- The BEV eco-bonus purchase incentive was trimmed from €7,000 down to €4,000 from January 1st 2025. PHEVs have (from January 1st) lost their previous waiver on weight-based taxes, leading to a loss in share.

- The successful 2024 “Social Leasing” scheme gave a boost to BEVs in the 2024 March to September period (affecting the baseline for YoY comparisons). This scheme will return (at a significantly more modest level) in September 2025, so we will see some hold-back effects on BEV sales, as we get near to its restart.

- General tightening of the CO2 emissions threshold for “malus écologique” taxes (from 113 g/km in 2025, and 105 g/km in 2026) means that emissions are increasingly heavily penalised. For example, vehicles emitting over 193 g/km can face penalties up to €70,000! This is encouraging a fast conversion of remaining ICE-only powertrains over to HEV and MHEV (see timeline graph below), and also helping EV sales somewhat.

- More broadly, the EU commission, in early March 2025, proposed a watering down of previously agreed 2025 EU vehicle emission targets. It was proposed that the previous plan for a year-by-year tightening, be replaced by a broader “averaged” compliance window (over 2025-2027), effectively making 2025 progress now voluntary, if compensated for in 2027. As of time of writing, this loosening of former targets is still a proposal making its way through the EU legislative maze.

- Finally, there are now several somewhat-affordable compelling BEVs available in the French market (Citroen e-C3, Renault 5, Fiat Grande Panda, Hyundai Inster, and others). The BYD Dolphin Mini may come to European markets later in the year, at an even lower price point. That these BEVs are now real choices in the market – even in the event their delivery times may require some patience – makes ICE alternatives relatively unattractive.

Against this backdrop, April market share figures are understandable. BEVs continue to slowly but surely grow, whilst PHEVs remain consistently below their 10% peak share of 2023. HEVs (and MHEVs) are a quick-and-cheap short term emissions reduction step for legacy auto, but not a long term solution.

Meanwhile combustion-only powertrains continue to diminish. Diesel-only fell from 7.7% share to 4.8% YoY. Petrol-only fell from 32.2% share to 20.9% YoY.

Best Selling BEV Models

The Renault 5 was once again the best selling BEV in April, marking its 4th pole-position of the past 6 months. Its larger sibling the Renault Scenic took second spot (up from 3rd in March). The Citroen e-C3 took third.

There were few big moves in the top 10 positions. The Tesla Model Y, in second place in March (Tesla’s normal peak volume month) fell back to 11th in April (a normal low-ebb month). Volume deliveries of the Juniper refresh are expected to begin in May or June, though it may take until the end of Q3 for a new steady-state to emerge.

The Kia EV3 climbed up to a record 10th place, with 551 registrations, from around 20th in the past couple of months. The new Skoda Elroq climbed into the top 20 for the first time, in 13th place with 519 units. It overtook its older and more expensive sibling, the Enyaq, let’s see if this new family pecking order is sustained.

The BYD Seal also entered the top 20 for the first time, in 14th spot, with 503 units, after having been on sale in France for around 18 months. This may be a record single-model volume for BYD in France (the Atto 3 saw 470 units back in December 2023).

The new Opel Frontera also saw its first top 20 ranking, in 18th spot, with 454 units.

We can also see that the new Citroen e-C3 Aircross landed in the top 20, in 16th position, with 495 units, a good result. Although our source data is limited to the top 20 models, it seems the Aircross may have seen modest initial customer volumes starting around February (let us know in the comments if you know more). Let’s see how popular it is compared to its ~10% smaller sibling, the regular e-C3.

Here’s the trailing 3-month chart (note that volume for Mini is estimated +/- 5%):

The Renault 5 is now consolidating its leadership in the French market, having led consistently for most of the past 6 months. The Citroen e-C3 is back in second place, and the Renault Scenic is in third.

We unfortunately don’t yet have enough data to define the 3-month rankings beyond 13th spot, but it is possible the Kia EV3 may have joined in around 20th spot for the first time, and its strong April result suggests it can climb further.

Outlook

April saw the overall French auto market return to the recent down-trend, with a 6% YoY volume decline. Only one month of the past 12 has avoided falling auto volumes YoY. In the broader French economy, we now have Q1 2025 GDP figures, showing 0.8% YoY growth – lacklustre and slightly below the Euro area average of 1.2%, but ahead of Germany (in recession). Inflation remained low at 0.5% and ECB interest rates declined to 2.4%. Manufacturing PMI improved slightly to 48.7 points in April, up from 48.5 in March.

With the Reanult 5 now taking a strong lead, and other small and affordable models climbing (and more coming) it seems the French market is finally putting the necessary ingredients in place for the mass-market BEV transition. It now just depends on decent available volumes of these models, and some degree of competition between them.

What are your thoughts on France’s EV transition? Please join the discussion below with your perspective and questions.

Whether you have solar power or not, please complete our latest solar power survey.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy