Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Last Updated on: 4th February 2025, 06:07 pm

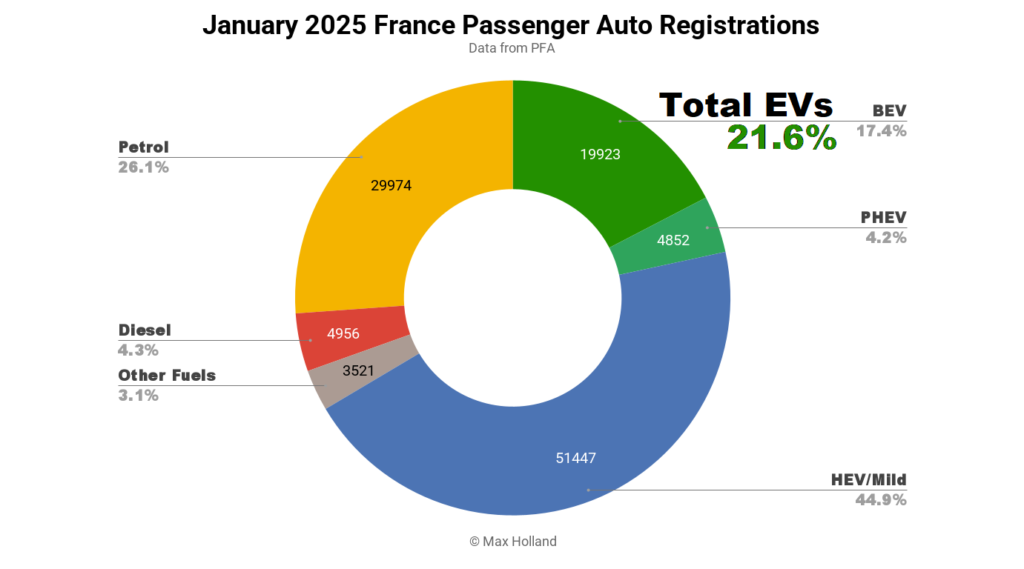

January’s auto sales saw plugin EVs take 21.6% share in France, a drop from 25.0% year on year. Most of the drop came from weak PHEV performance, whilst BEV share grew slightly YoY. Overall auto volume was 114,673 units, down over 6% YoY, and far from pre-covid seasonal norms (around 150,000). The new Renault 5 was the best selling BEV in January, reclaiming its recent period of leadership from the Tesla Model Y.

January’s auto sales totals saw combined plugin EVs take 21.6% share in France, with 17.4% full battery-electrics (BEVs) and 4.2% plugin hybrids (PHEVs). These compare with YoY figures of 25.0% combined, 16.4% BEV and 8.6% PHEV.

A tumble in PHEV volume YoY (from 10,545 down to 4,852) meant a halving of PHEV share, and a big dent in combined plugin share. The PHEV drop came largely as a result of the relatively new weight-based auto taxes now being applied to PHEVs from January 1st (in 2024 they were given a waiver).

In a shrinking overall auto market, BEV volume took only a fractional dip (less than half a percent), much better than the average 6.2% dip. Thus, BEVs improved their market share slightly YoY.

The biggest gains were seen for plugless HEVs and mild-hybrids, which stepped up massively from 26.6% to 44.9% share YoY. Producing mild hybrids appears to be the main approach that legacy automakers are taking in the French market to meet 2025’s tighter emissions rules. Will this be enough? Probably not by itself, but moving to MHEV powertrains is the quickest and cheapest short-term way to reduce emissions (by about 10%) if you’re a legacy automaker stuck in the ICE age.

As we saw with the tightening of emissions targets in both 2020 and 2021, we will likely see BEV volumes from legacy auto start to increase more steeply only towards the end of 2025 to meet this year’s tightened targets.

As a rough guide, the French auto industry lobby, the PFA, is suggesting that BEVs may have to get close to an average share of 22% this year. Since there are some fudges allowed, the PFA’s “hard to get to 22%” narrative may be a sob-story to push for more handouts, but certainly around or above 20% BEV share seems likely.

With BEVs slightly increasing in share, PHEVs down, and plugless hybrids up considerably, ICE-only powertrains saw a steep YoY drop in share in January, as we would expect in an emissions-tightening year. Diesel-only volume fell by 48% YoY to 4,956 units and a record low share of 4.3%. Petrol-only volume fell 28% to 29,974 units and a near-record low share of 26.1%.

Best Selling BEV Models

With only a brief interruption in December, the new Renault 5 has held the top spot for two of the last three months. Its January volume was 2,813 units.

The new Citroen e-C3 also did well to grab second spot with 1,548 units, though was some way down from its levels in September and October. The Renault Scenic took third, with 1,177 units.

Seven out of the top 10 best sellers were from French (or French owned) manufacturers, mainly Renault Group and Stellantis. There were no great surprises here, but we did see the relatively new Kia EV3 join the top 20 ranks in France for the first time. I’m personally glad to see the Dacia Spring — still Europe’s most affordable BEV in most countries — now solidly back into the top 10 over the past three months, despite numerous hurdles and barriers being placed in its way.

There’s an echoing narrative going around in the French auto media that Tesla’s January volumes “collapsed” 63% YoY, which sounds exciting and dramatic, but it is a distorted perspective which deliberately removes all context. One aspect of that context is that the January 2024 baseline saw 6x higher-than-normal volumes of the Model 3. Why? This was a pull-forward ahead of BEVs from outside Europe losing access to purchase incentives from mid March 2024. The other context is that the Tesla Model Y refresh is still not quite yet delivering in volume in France, and many potential Tesla shoppers are likely waiting for that.

No doubt Tesla may indeed not be as strong in France in 2025 as it was in the past, since a much wider array of competent BEV options are now available, starting from somewhat affordable price points. But don’t expect a 60+ % drop in Tesla’s YoY unit volumes in 2025, perhaps more like the 13% drop seen in Europe between 2023 and 2024. Volume will depend on Tesla’s pricing strategy and the possible launch of a more affordable model.

Meanwhile, domestic brand BEVs under Renault Group and under Stellantis will continue to go from strength to strength in 2025, as more and more affordable models (often variants of the same platform) are launched, all whilst the existing Renault 5 and Citroen e-C3 further ramp up. The Renault 4 will see first deliveries perhaps before the summer (the new Renault Twingo must wait until 2026). The slightly enlarged Citroen e-C3 “Aircross” will be delivered around the middle of this year. Peugeot could also tweak the pricing of the e-208 a bit.

Stellantis’s Fiat brand will also offer some more affordable models in 2025, including the Fiat Grande Panda and the (already delivering) Abarth-badged “600E” variant of the Fiat 600.

The European brands won’t have it all their own way, though. Hyundai has just launched the very compelling Hyundai Inster in France (no volume data yet), and BYD has just launched the Atto 2. These two join the Abarth 600E in the B-segment.

Let’s watch this space. Meanwhile, here’s the 3-month ranking:

Most of the top 20 remains largely static, with the exception of the great performance of the new star, the Renault 5, which jumps up from its near-debut 10th position in the August–October period to the top spot now. Based on its recent performance, the Renault 5 is likely to remain on top for most of (perhaps all of) 2025.

The other big step up was for the Dacia Spring. The Spring spent a long period at low volumes prior to November, and far outside the top 20. Now back to decent volumes, it has climbed up to 6th spot over the trailing 3 months, closer to its glory days of 2021–2023.

With the launches of the upcoming affordable models mentioned previously, let’s see if and when any of them (e.g., the Renault 4) manage to shake up this ranking later in the year.

Outlook

Along with the auto market shrinking by some 6% YoY, France’s broader economy is also not doing great, with Q4 2024 economic data calculated to show YoY GDP growth of just 0.7%, down from 1.2% in Q3. Headline annual inflation is at 1.4% and interest rates are now at 2.9%. Manufacturing PMI improved to 45 points in January, though is still distinctly negative (under 50 points).

As discussed in recent reports, since legacy manufacturers are still doing “the minimum possible” to transition, the growth of BEVs in 2025 will largely be shaped by the new EU rules around emissions tightening. I mentioned above that this should correlate with a BEV share somewhere around 20% on average across the EU zone in 2025, perhaps slightly higher. This is not great, but will be an improvement over the falling BEV share in several European countries between 2023 and 2024.

France itself saw flat BEV share in 2024, better than some neighbours, and will be back to growth this year. I’m keen to see the level of success of these new (somewhat) affordable BEV models from European brands. I’m hoping that their mere existence, and the competition between them (and their ever growing volumes) will put downward pressure on pricing of the adjacent BEV segments, and ultimately bring mass-market BEVs much closer to ICE “alternatives” in pricing. Most of China’s BEVs already passed price-parity with ICE-cars in 2024. When will this happen in Europe?

What are your thoughts on France’s auto market and prospects for 2025? What new BEV models are you looking out for? Please jump in to the discussion in the comments section below.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy