Image source: Getty Images

Figuring out your dividend income is much easier when an investment has a history of steady payouts. Most stocks pay dividends quarterly, with the amount fluctuating based on earnings and board decisions. Ideally, they increase their payout over time—but there’s no guarantee.

Closed-end funds (CEFs) like Canoe EIT Income Fund (TSX:EIT.UN) operate differently. They follow a managed distribution policy, meaning they set a fixed payout regardless of market conditions. In EIT.UN’s case, that means a monthly $0.10 per share distribution—like clockwork. Here’s how that translates into yearly income.

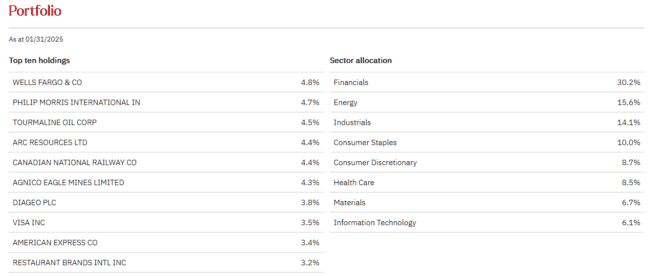

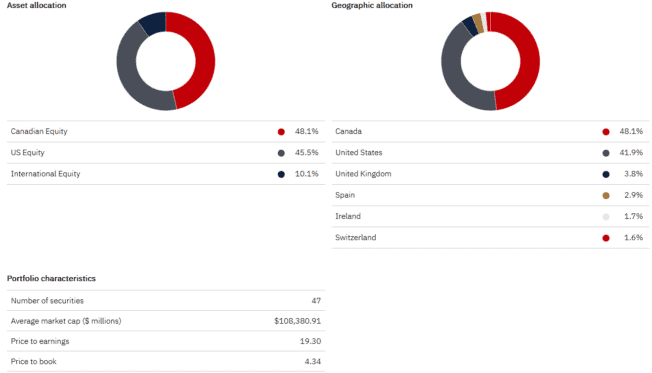

What is EIT.UN?

EIT.UN is a collection of U.S. and Canadian stocks, primarily selected for quality, packaged into a single ticker that trades like a stock.

The hallmark of EIT.UN is its monthly distribution of $0.10 per share, paid like clockwork. The fund typically goes ex-dividend around the 14th or 15th of each month, meaning you need to own shares before this date to qualify for the payout. Distributions are then deposited on the 24th or 25th of the following month.

The distribution isn’t technically a dividend. While part of it may be taxed as eligible dividends, other portions can be capital gains or return of capital (ROC). To keep taxes simple, it’s best to own EIT.UN in a Tax-Free Savings Account (TFSA).

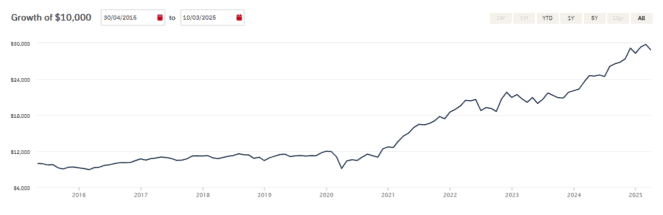

Even though EIT.UN is designed as an income-oriented fund, it hasn’t been a slouch on the growth side. Over the past 10 years, it has delivered an annualized return of 11.89%, assuming you reinvested the distributions.

How many shares do you need to own to get paid $500 per month?

The math is easy thanks to EIT.UN’s steady $0.10 per share monthly distribution. Since this payout is fixed, you can calculate exactly how many shares you need to generate $500 per month.

Each share pays $0.10 per month, so to determine the number of shares required, divide your target monthly income by the per-share payout: $500 ÷ $0.10 = 5,000 shares

Now that you know you need 5,000 shares, the next step is calculating how much that investment would cost at today’s price.

As of March 11, each EIT.UN share trades at $14.77. To buy 5,000 shares, you’d need to invest: 5,000 × $14.77 = $73,850

That means to earn $500 per month, you’d have to invest about $73,850 in EIT.UN at its current price.

Of course, this assumes EIT.UN continues paying its current distribution. While the fund has maintained its payout so far, no income investment is guaranteed. Distributions can be reduced if market conditions change, which is why it’s important to diversify rather than rely on a single fund for all your income needs.