What do institutional investors like the Canada Pension Plan (CPP), Yale University’s endowment, and BlackRock all have in common?

You might say they invest for the long term, employ extensive research and teams of experts, focus on diversification, or avoid emotional decisions—all true. But one thing that might slip your mind is their consistent allocation to infrastructure assets.

While you might not have access to the private infrastructure deals that institutional giants do, retail investors can still tap into the same theme through publicly traded infrastructure equities.

Here’s an exchange-traded fund (ETF) I believe is well-suited for a $9,000 investment if you’re aiming for early retirement with reliable income and long-term growth.

What is infrastructure, and what are its benefits?

Infrastructure includes the systems and services we rely on every day but rarely think about. Power lines, water treatment facilities, highways, natural gas pipelines, cell towers, and ports—these are all examples of infrastructure assets that keep modern life running smoothly.

While they serve very different purposes, infrastructure assets tend to have a few important things in common. Most generate high free cash flow, often from long-term contracts or regulated pricing models. Because the services they provide are essential, the revenue they earn is usually steady and predictable, even when the economy slows down.

Infrastructure is also known for being sensitive to inflation—in a good way. Many of these businesses can pass rising costs on to users, and some even have automatic inflation-linked price escalators built into their contracts. Pipelines, for instance, often have rate structures tied to inflation indexes.

The result is an asset class that spits out reliable cash, offers potential for capital appreciation, and doesn’t always move in lockstep with the broader stock market. That makes it a strong addition to a well-diversified portfolio.

How to invest in infrastructure with $9,000

One of the best ways to gain infrastructure exposure with a single investment is through BMO Global Infrastructure Index ETF (TSX:ZGI). As of April 18, ZGI trades at around $52 per share, so a $9,000 investment would buy you roughly 173 shares.

The ETF holds 50 infrastructure stocks and tracks the Dow Jones Brookfield Global Infrastructure North American Listed Index. To be included, companies must meet minimum size requirements and trade with sufficient volume. They also must be listed in Canada or the U.S., and at least 70% of their cash flow must come from owning, operating, leasing, or managing infrastructure assets.

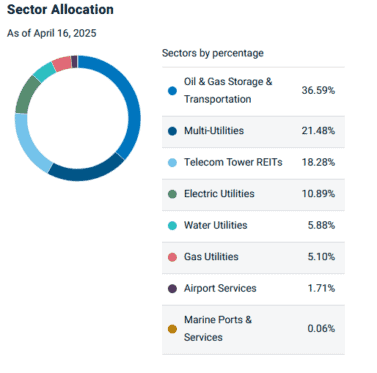

ZGI’s portfolio spans nearly every major infrastructure category, including oil & gas storage and transportation, multi-utilities, telecom tower real estate investment trusts, electric utilities, water utilities, gas utilities, and airport services.

It’s a solid-sized fund with $588.84 million in assets under management and charges a 0.55% management expense ratio. While not the cheapest, that’s expected for a more specialized ETF. It currently pays a 2.84% distribution yield, and over the past five years, it has delivered a strong 12.95% annualized return.