Image source: Getty Images

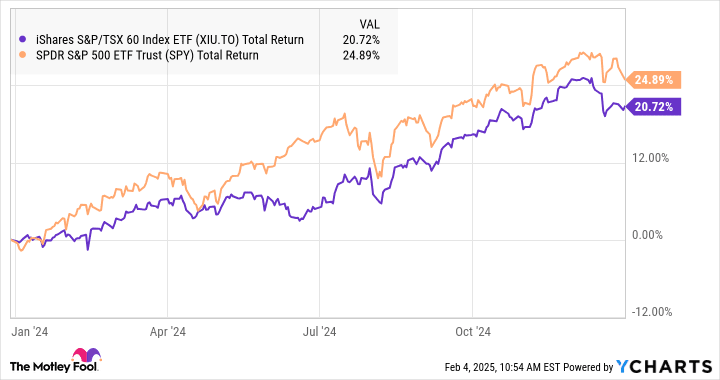

The stock markets of both Canada and the United States have experienced impressive returns, with the Canadian market gaining close to 21% and the U.S. marketing returning about 25% last year, according to YCharts. These returns have outpaced their 10-year averages, which stand at around 9% for Canada and 13% for the U.S. Given such strong gains, it’s logical for investors to expect some form of pullback. A market correction, especially triggered by the ongoing Canada-U.S. trade tensions, could offer an unexpected opportunity for Canadian investors.

XIU and SPY Total Return Level data by YCharts

Let’s explore why a dip in the markets, driven by a trade war, could be a hidden blessing for investors seeking long-term gains.

A potential market correction

After an extraordinary year in 2024, it seems reasonable to anticipate some volatility or market correction in the near future. Historically, the stock market tends to rise over the long term despite the inevitable short-term fluctuations. For Canadian investors, a dip in prices driven by trade tensions could provide an excellent chance to buy quality stocks at more attractive valuations.

A market correction could feel unsettling, but it’s worth remembering that corrections often present buying opportunities for those with a long-term horizon. Investors who purchase on dips tend to see strong gains as the market recovers.

A smart strategy: Dollar-cost averaging

During volatile periods, one of the best strategies is to average into positions. Instead of committing a large sum of money all at once, consider splitting your investment over time. For instance, if you plan to invest $9,000 in a stock, you could divide it into three purchases of approximately $3,000 each, spaced out over several months. This strategy helps to smooth out the impact of market fluctuations, ensuring you don’t buy everything at a peak.

For more conservative investors, an alternative to picking individual stocks is to invest in broad market exchange-traded funds (ETFs). ETFs like iShares S&P/TSX 60 Index ETF and SPDR S&P 500 ETF Trust allow you to gain exposure to the overall Canadian and U.S. stock markets, respectively, without having to worry about individual stock selection.

Here are examples of solid stocks that have been holding steady so far in this trade war.

Canadian Pacific Kansas City

Canadian Pacific Kansas City (TSX:CP) has remained relatively stable in the face of trade war volatility, trading at similar levels as it did a year ago. Over the past decade, CP has consistently delivered strong earnings growth, with an annual adjusted earnings-per-share (EPS) growth rate of more than 11%. The merger between Canadian Pacific and Kansas City Southern created an extensive rail network that spans Canada, the U.S., and Mexico. Given the close economic ties between these countries, CP stands to benefit from ongoing trade activity between them, even amidst trade disputes.

Any short-term pullback in CP stock could present an opportunity to buy at a discount. Investors with a long-term perspective will likely find value in this railway giant, especially as trade between Canada, the U.S., and Mexico remains a key driver of CP’s growth.

Johnson & Johnson

As a global leader in healthcare, Johnson & Johnson (NYSE:JNJ) has shown remarkable resilience through challenging market conditions. Despite trade tensions, J&J’s stock is only down about 2% from a year ago. In fact, including dividends, investors would have seen no overall loss in the past 12 months. Over the last decade, J&J has delivered solid earnings growth of 6% per year, demonstrating its ability to weather economic storms.

For risk-averse investors, J&J is an attractive option. The stock trades at a reasonable price-to-earnings ratio of around 15.3, and analysts predict a 10% upside from its current price. In addition, J&J pays a 3.2% dividend yield, offering income to investors during periods of uncertainty.

For Canadian investors, one potential benefit is the availability of J&J stock on the Neo Exchange, which helps avoid costly foreign exchange conversion when trading in U.S. dollars. This could be a practical way to gain exposure to a steady, defensive stock while mitigating currency risk.