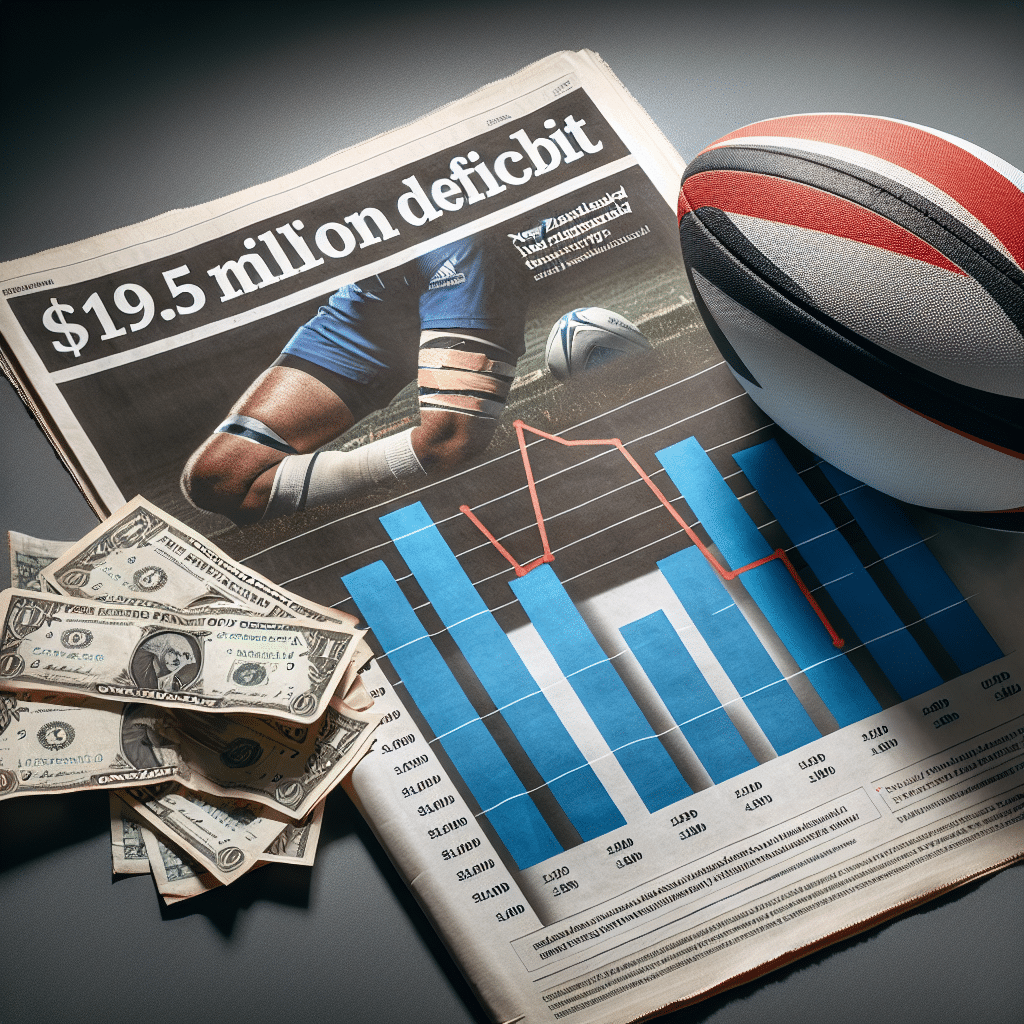

New Zealand Rugby Announces $19.5 Million Deficit

New Zealand Rugby (NZR) has recently announced a significant deficit of $19.5 million. This news comes as a surprise to many, given the popularity and success of the sport in the country. However, it’s not all doom and gloom for the organization, as this deficit is offset by a record level of income and revenue.

Understanding the Deficit

The deficit announced by NZR is a result of various factors. The most significant of these is the impact of the COVID-19 pandemic, which has led to a decrease in match-day revenue due to restrictions on crowd sizes. Additionally, the costs associated with running the sport at a professional level have also increased, contributing to the deficit.

Record Level of Income and Revenue

Despite the deficit, NZR has reported a record level of income and revenue. This has been driven by a number of factors, including increased broadcast revenue, sponsorship deals, and the success of the All Blacks, New Zealand’s national rugby team. The organization has also been successful in diversifying its income streams, with revenue from non-traditional sources such as digital platforms and merchandise sales.

Regional Impact and International Relevance

The financial performance of NZR has significant implications for the wider New Zealand economy. Rugby is a major part of the country’s cultural identity and contributes significantly to its tourism industry. The success of the All Blacks also enhances New Zealand’s international reputation, attracting investment and creating business opportunities.

Furthermore, the financial health of NZR is of international relevance. The organization is a major player in the global rugby scene, and its financial performance can impact international rugby bodies and competitions. For instance, a financially strong NZR can invest more in player development and infrastructure, enhancing the quality of international rugby.

What This Means for Investors

While the deficit is a concern, the record level of income and revenue is a positive sign for investors. It indicates that NZR has the ability to generate significant income, despite the challenges it faces. This could make it an attractive investment opportunity for those interested in the sports industry.

Investors should also consider the wider implications of NZR’s financial performance. The organization’s ability to generate income can have a positive impact on the New Zealand economy, potentially creating investment opportunities in related sectors such as tourism and hospitality. Furthermore, a financially strong NZR can contribute to the growth and development of international rugby, creating opportunities for investors in other markets.

Summary

In conclusion, while the $19.5 million deficit announced by New Zealand Rugby is a concern, it is offset by a record level of income and revenue. This demonstrates the organization’s ability to generate significant income, despite the challenges it faces. The financial performance of NZR has significant implications for the wider New Zealand economy and the international rugby scene, potentially creating investment opportunities in related sectors and markets. Investors should keep a close eye on the organization’s financial performance and the wider implications it could have.