Nvidia and AMD Propel Chip Sector to Record High Since February

Two of the leading players in the semiconductor industry, Nvidia and Advanced Micro Devices (AMD), have recently driven the chip sector to its highest level since February. This surge has prompted one analyst to suggest that it’s time to return to fundamentals when considering Nvidia’s stock.

Back to Basics with Nvidia

While the tech sector has been a rollercoaster of volatility in recent months, Nvidia’s strong performance has been a beacon of stability. The company’s robust financials, innovative product line, and strategic positioning in the market have made it a favorite among investors. The recent surge in the chip sector has further solidified Nvidia’s standing, prompting analysts to suggest a return to fundamentals when evaluating the company’s stock.

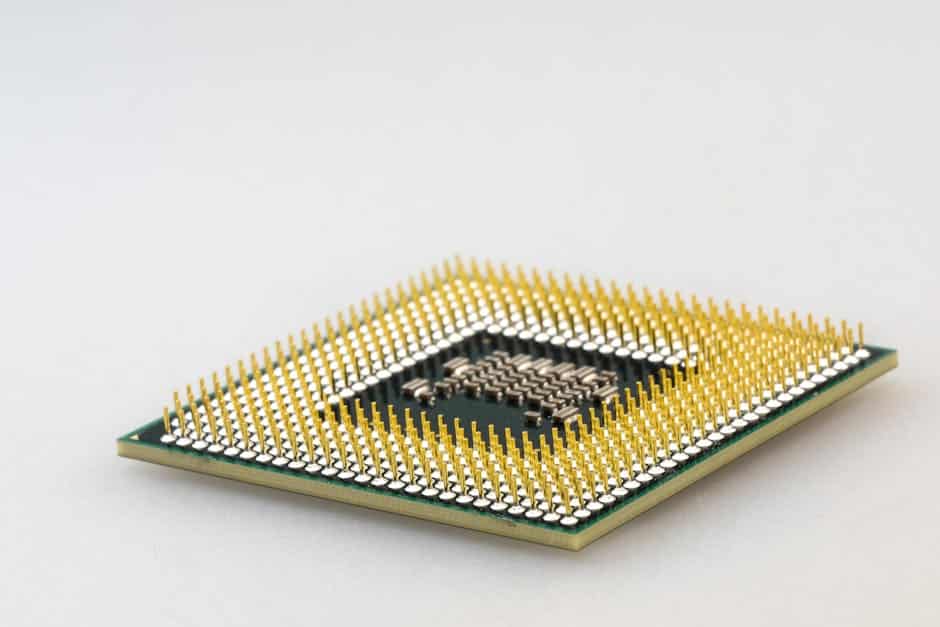

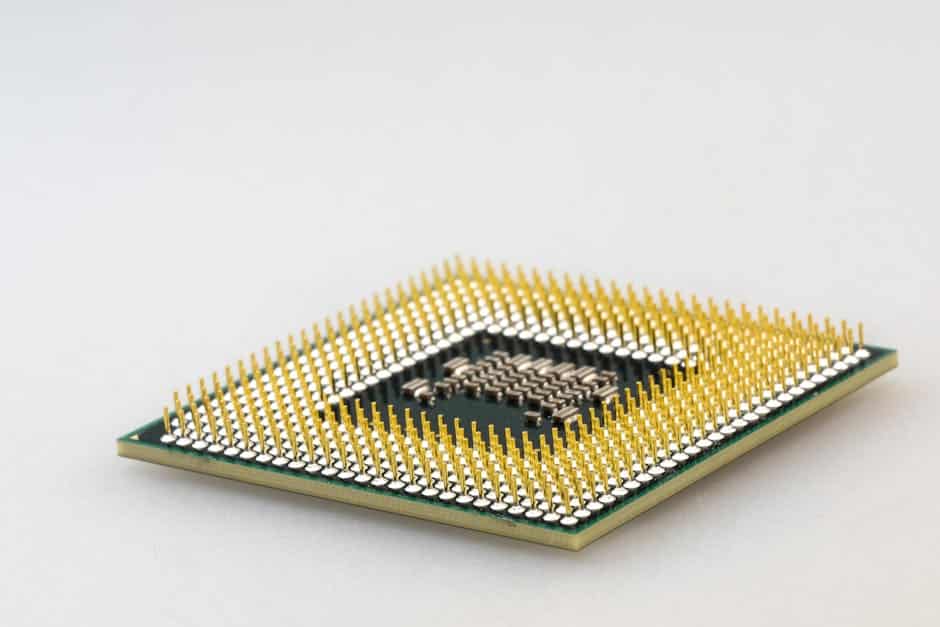

Looking at Nvidia’s fundamentals, the company’s strong balance sheet, impressive revenue growth, and consistent profitability make it an attractive investment. Furthermore, Nvidia’s leadership in the graphics processing unit (GPU) market and its growing presence in the data center and artificial intelligence (AI) sectors provide a solid foundation for future growth.

AMD’s Role in the Chip Sector Surge

AMD, another heavyweight in the semiconductor industry, has also played a significant role in the recent chip sector surge. The company’s innovative product offerings, particularly in the CPU and GPU markets, have helped it gain market share and boost its financial performance.

AMD’s recent launch of its new Ryzen 5000 series of desktop processors, which have been praised for their superior performance, has further bolstered the company’s standing in the market. Additionally, AMD’s planned acquisition of Xilinx, a leader in the field of programmable logic devices, is expected to enhance its product portfolio and provide new growth opportunities.

Implications for the Broader Tech Sector

The strong performance of Nvidia and AMD has positive implications for the broader tech sector. It signals robust demand for high-performance computing solutions, driven by trends such as AI, machine learning, and data analytics. This demand is expected to continue growing, providing a tailwind for companies in the semiconductor industry.

Furthermore, the surge in the chip sector could also benefit other tech sub-sectors, such as cloud computing, cybersecurity, and automation. These areas rely heavily on advanced computing solutions, and the strong performance of companies like Nvidia and AMD could drive further innovation and growth in these fields.

Summary

The recent surge in the chip sector, driven by Nvidia and AMD, is a positive sign for investors in the tech industry. It indicates strong demand for advanced computing solutions and suggests potential for continued growth. Investors should keep an eye on the fundamentals of leading companies like Nvidia and closely monitor developments in the broader tech sector. The performance of these companies could have significant implications for other tech sub-sectors and the overall market.